Introduction to Exchange-Traded Fund (ETF)

May 16, 2024 By Susan Kelly

Investors who want to have a variety of investments in their portfolios need to comprehend the details of Exchange-Traded Funds (ETFs). This article will study the advantages and disadvantages of ETFs, helping investors make good choices.

Benefits of ETFs

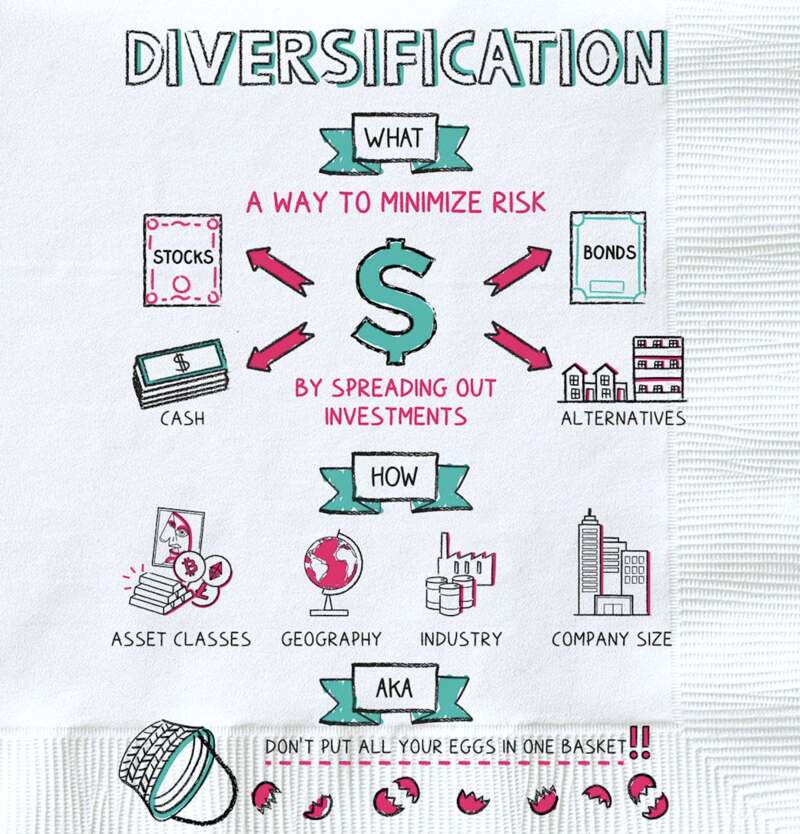

ETFs have many benefits for investors. One is they give diversification in different assets, lessening the risks from individual stocks. When you put your money into an ETF that has a collection of securities, you spread out your risk across several companies or areas. This means if one company does badly it won't greatly affect how much money you've invested overall because others may perform better and balance things out. Moreover, ETFs usually have lesser expense ratios in comparison to mutual funds. This makes them an economical choice for investment.

The cost-effectiveness of ETFs is especially advantageous for people who invest long-term because fewer expenses result in more net returns over some time. Also, ETFs allow trading during the day which gives ease and flexibility to investors. In contrast to mutual funds of the old-fashioned type that have their price set once per day after market hours, ETFs can be bought and sold all through a trading day. This allows investors to make swift responses to shifts in the market or alter their positions whenever required.

- Tax Benefits: ETFs often have lower capital gains distributions compared to mutual funds, reducing tax liabilities for investors.

- Global Exposure: Some ETFs offer exposure to international markets, allowing investors to diversify geographically and access growth opportunities beyond domestic borders.

Risks Associated with ETFs

Although ETFs are advantageous, they also have some risks. One significant risk is tracking errors. This takes place when an ETF's performance does not match the performance of its underlying index. Many factors can cause this discrepancy like imperfect copying of the index, trading expenses, or variations in timing between rebalancing of indexes and adjustments made by ETFs themselves. Furthermore, for investors they might face problems with liquidity especially if the ETF is not traded much or when the market is turbulent.

When this happens, the difference between what you can buy an ETF for (ask price) and sell it (bid price) becomes bigger which makes transactions more expensive. Also sometimes it could be hard to make trades at prices that were hoped because of wider spreads. In addition to these risks, ETFs can also be affected by market risks like volatility and changes in prices which influence how well a whole group of assets performs together known as portfolio performance on the balance sheet (Klein 2021). Although diversification helps to reduce certain risks, investors must accept the natural fluctuations that come with market investments.

- Counterparty Risk: Some ETFs use derivatives or engage in securities lending, exposing investors to counterparty risk if the counterparties fail to fulfill their obligations.

- Regulatory Changes: Changes in regulations or tax laws can impact the structure or taxation of ETFs, affecting their returns and attractiveness to investors

Tax Efficiency Considerations

ETFs usually present a feature of being tax efficient, thanks to their special format. Unlike mutual funds where capital gains taxes may happen because of redemptions, ETFs often decrease the amount of capital gains distributed. This nature that is efficient for taxes can increase the returns over time for investors, making ETFs an appealing choice when it comes to accounts with taxable features.

Additionally, ETFs allow investors to control the timing of their tax liabilities by choosing when to buy or sell shares. Unlike mutual funds, where transactions initiated by other investors can trigger capital gains distributions for all shareholders, ETF shareholders have more control over their tax consequences. Furthermore, certain ETF structures, such as index replication rather than active management, can reduce portfolio turnover and minimize taxable events, further enhancing tax efficiency.

- Dividend Reinvestment: Many ETFs offer dividend reinvestment plans (DRIPs), allowing investors to automatically reinvest dividends without triggering taxable events, thereby maximizing compound returns.

- Tax-Loss Harvesting: Investors can utilize tax-loss harvesting strategies with ETFs to offset capital gains with capital losses, potentially reducing overall tax liabilities in a taxable portfolio.

Diversification Benefits

A feature that makes ETFs very interesting is their ability to give broad exposure across different kinds of assets. With just one investment, you can have access to many stocks, bonds, commodities, or sectors. This spreading out helps reduce risks linked with particular securities and might enhance the stability of a portfolio while possibly improving returns over time.

Moreover, the flexibility of ETFs is another attractive feature. It permits investors to customize their diversification by selecting specific market portions or investment themes that match their strategies. Whether someone wants a wide-ranging market exposure or they are focusing on particular areas, ETFs provide a handy and effective method for achieving diversification within one's portfolio.

- Sector Rotation Strategies: Some ETFs specialize in sector rotation, allowing investors to capitalize on changing economic trends or market cycles by adjusting sector allocations dynamically.

- Smart Beta ETFs: Smart beta ETFs employ alternative index construction methodologies to target specific factors such as value, momentum, or low volatility, offering investors enhanced diversification beyond traditional market-cap-weighted indices.

Leveraged and Inverse ETFs

Leveraged and inverse ETFs give different ways of trading to investors who want more returns or chances for hedging. Leveraged ETFs are designed to increase the daily gains of an underlying index, usually by using derivatives like swaps or futures contracts. These types of funds provide double or triple exposure to the index's performance, making it possible for investors to amplify their gains when market conditions are bullish.

Yet, it is important to acknowledge the increased danger and instability linked with these specialized ETFs. As daily returns accumulate, leveraged ETFs might encounter substantial losses in unstable markets or when there are lengthy downturns. Before including leveraged ETFs in their portfolios, investors should examine their ability to tolerate risk and investment goals very carefully.

- Daily Reset: Leveraged ETFs reset their exposure daily, which can lead to tracking errors and deviations from the intended leverage ratio over longer holding periods.

- Inverse ETFs as Hedging Tools: Inverse ETFs provide a means for investors to profit from declining markets or hedge against downside risk in their portfolios. However, inverse ETFs are designed for short-term trading purposes and may not accurately reflect inverse returns over extended periods due to compounding effects.

Conclusion

Investors can gain many advantages from Exchange-Traded Funds (ETFs); they are cost-efficient, easy to buy or sell, and have tax benefits. However, it is important for investors to carefully consider the risks that come with ETFs such as tracking errors or changes in market value. By looking at these points in this guide, people who invest can make smart choices about including ETFs in their investment plans.

Dec 26, 2023

Investment

Investing In Space Exploration

Space exploration has been one of the areas that many argue is the sole responsibility of governments. Space exploration does not only have a high cost and uncertain economic benefits, which are a scourge for companies; however, many experts and observers are concerned that their participation could affect the integrity of pure science or cause uncontrolled land grabs that are hard to judge in courtrooms on the ground.

Nov 30, 2024

Investment

A Practical Guide to the Sinking Fund Method: What It Is, How It Works, and Its Advantages

Discover the sinking fund method, a strategic approach to managing debt and asset depreciation. Learn how it works, its benefits, and why it’s essential in corporate finance and personal investment.

Nov 03, 2023

Know-how

Accident in a Rental Car

Dealing with car rental coverage and insurance claims requires you to take a few more procedures.

Nov 15, 2023

Taxes

Reasons for Additional Medicare Tax on Wages

The Additional Medicare Tax was first enacted into law in 2010 as a component of the Patient Protection and Affordable Care Act (ACA), and it was subsequently modified by the Health Care and Education Reconciliation Act not long after that.

Sep 10, 2024

Investment

Mastering the Market: David Gardner’s Stock Picks for Lasting Success

Explore how David Gardner’s stock picks have shaped a path to investment success. Learn about his strategies and what makes his approach stand out in the stock market

Dec 02, 2024

Business

The Power of Personalization in Consumer and Business

Paradoxically, one of the most overlooked business strategies involves consolidating all your banking with one provider.

Sep 10, 2024

Investment

Navigating Tiny House Financing in 2024: What You Need to Know

The best tiny house financing options in 2024. This guide covers everything from loans to personal savings, making your tiny home dream a reality

Nov 30, 2024

Investment

Blotters in Finance: How They Work, Why They Matter, and Practical Applications

Learn what a blotter is, how it functions, and its uses in finance. From tracking trades to keeping accurate records, discover the essential role of blotters in financial and operational settings with examples for a clear understanding.

Dec 13, 2023

Know-how

Seven Key Traits of an Exceptional Accountant in Modern Business

Many qualities like staying up-to-date, being organized, and being patient make you an exceptional accountant. Read more of these traits in this article.

May 16, 2024

Taxes

Introduction to Exchange-Traded Fund (ETF)

Explore the advantages and disadvantages of Exchange-Traded Funds (ETFs) in this comprehensive guide to informed investing.

Jan 23, 2024

Investment

Ways of Investments

The timing of when you sell investments might also affect your annual tax bill. It is necessary to pay capital gains taxes on any earnings from investments. If you sell an investment for less than you originally paid for it, you can use the amount by which the sale reduced your gain on your tax return

Dec 01, 2024

Banking

A 2024 Review of Teachers Federal Credit Union Personal Loans: What You Need to Know

Explore our comprehensive Teachers Federal Credit Union Personal Loan Review 2024. Learn about loan options, interest rates, and eligibility criteria to help you make an informed borrowing decision.